A recent study finds U.S. companies that have a substantial number of employees in foreign jurisdictions with lower tax rates are more likely than their peers to “artificially” locate earnings in those jurisdictions – and the Internal Revenue Service (IRS) is less likely to challenge these complex tax-planning activities.

“Many politicians seek to encourage domestic employment and discourage sending jobs overseas,” says Nathan Goldman, co-author of the study and an assistant professor of accounting in North Carolina State University’s Poole College of Management. “To do that, they’ll need to address elements of corporate tax policy that effectively encourage corporations to ramp up their percentage of foreign employees.”

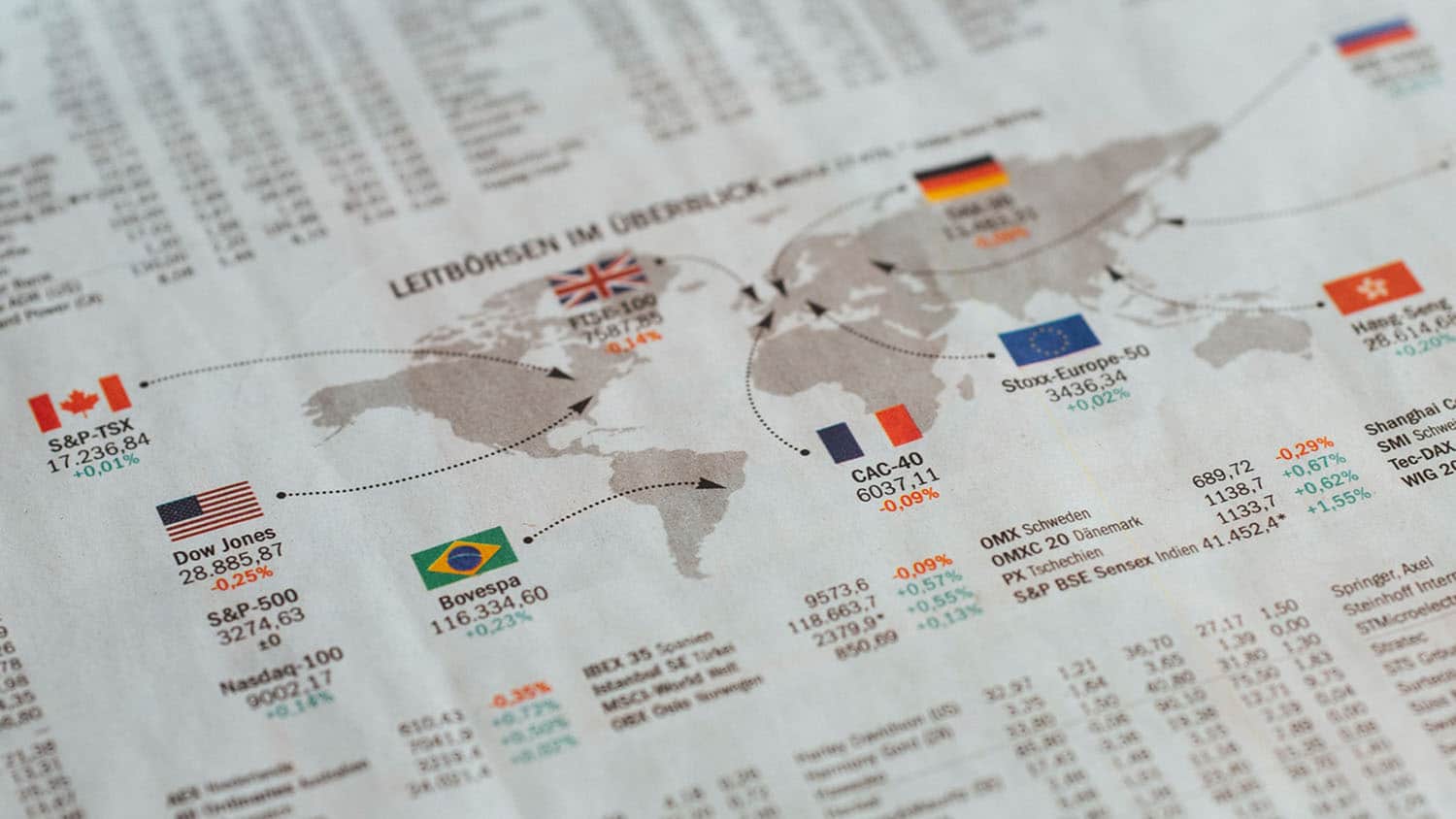

The researchers were interested in determining how foreign employment affected income shifting by large companies, and tax uncertainty regarding the foreign transactions of those companies. Income shifting is when companies artificially locate earnings in a low-tax jurisdiction. For example, one form of income shifting is when a company alters intercompany pricing by charging unusual prices to transfer income from the part of the company that earned the money to the part of the company that is based in a low-tax jurisdiction – particularly when there is no reason to do so other than to avoid taxes. Tax uncertainty refers to the likelihood that an IRS audit will result in the company having to pay more in taxes.

For this study, the researchers looked at data from 815 large, multinational companies based in the U.S. The researchers collected financial data on all of the companies for each year between 2000 and 2016. During that time period, all of the companies had at least one year during which they recorded at least $100 million in foreign sales. The average firm in the sample, during the average year, had 18,763 employees, of which 8,499 were employed outside the U.S.

The researchers used empirical models that allowed them to identify whether companies were recording unusually high profit margins in low-tax jurisdictions relative to the U.S. – which would suggest that companies were engaging in income shifting.

The researchers found companies that had a higher percentage of foreign employees were more likely to have unusually high profit margins overseas. In addition, those companies recorded fewer unrecognized tax benefit reserves on their financial statements, which reflects lower tax uncertainty. In other words, companies appear to be facing less scrutiny from the IRS related to their aggressive tax planning activities.

“Think of it this way: If a company only has a few employees in a low-tax jurisdiction and claims a huge profit there, the IRS is likely going to single that company out – the amount of profit is out of scale with the size of the operation,” Goldman says. “But if a company has a lot of employees in that jurisdiction, the profits appear more reasonable, and the relevant business activities are less likely to get singled out by the IRS for a rigorous audit.

“One of the takeaways here is that the tax code effectively encourages companies to increase the percentage of their employees who work in foreign jurisdictions that have low tax rates. Not just because of a higher U.S. tax rate, but because the company is better able to substantiate the economic substance of their transactions, resulting in a higher likelihood of defending these aggressive tax planning activities in an IRS audit.”

Leave a Reply