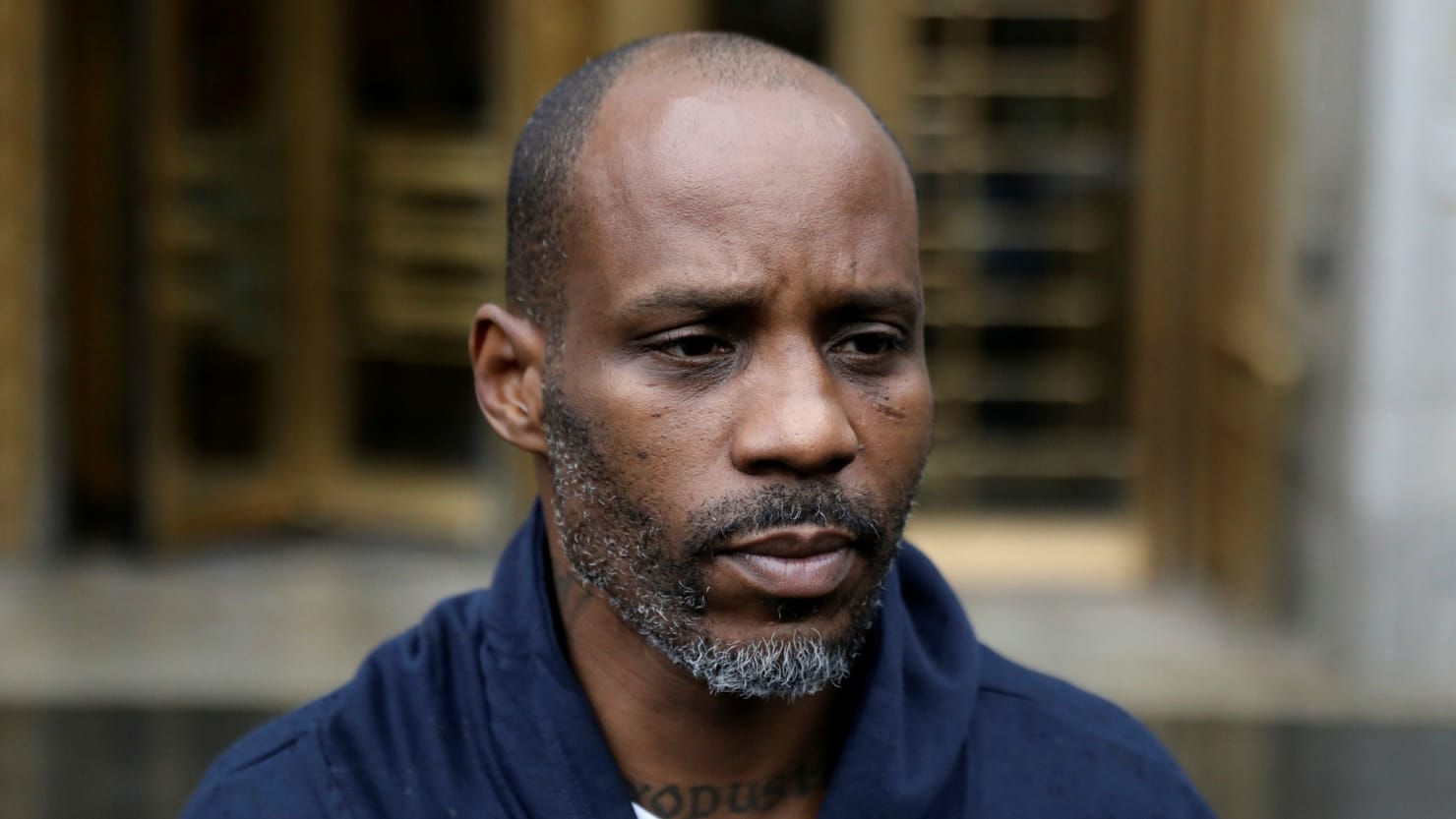

Geoffrey S. Berman, the United States Attorney for the Southern District of New York, announced that Earl Simmons, known professionally as “DMX” and “X,” was sentenced today in Manhattan federal court to one year in prison for tax fraud in connection with evading the payment of income taxes in the period from 2010 through 2016. In total, during that time period DMX concealed millions of dollars of income from the IRS and avoided paying $1.7 million of tax liabilities. DMX pled guilty on November 30, 2017, before United States District Judge Jed S. Rakoff, who imposed today’s sentence.

U.S. Attorney Geoffrey S. Berman said: “Earl Simmons, the recording artist and performer known as DMX, stole from the American taxpayers when he earned millions of dollars but failed to pay any taxes on his income. Today’s sentence shows that star power does not entitle people to a free pass. Together with our partners at the IRS, we will vigorously enforce our tax laws to make sure that people pay their fair share.”

According to the Indictment and statements made in open court:

DMX worked as a recording artist, performer, and actor. Beginning in 1997, DMX released a series of hip-hop albums that sold millions of records. Many of his albums went platinum and occupied the top positions on musical charts. During his career, DMX has performed at venues across the United States and around the world, and has acted in motion pictures.

As a result of the income DMX earned from sources including musical recordings and performances, from 2002 through 2005 he incurred federal income tax liabilities of approximately $1.7 million. Those liabilities went unpaid, and in 2005, the IRS began efforts to collect DMX’S unpaid tax liabilities.

During the period from 2010 through 2015, DMX earned more than $2.3 million, but DMX did not file personal income tax returns during that time period. Instead, he orchestrated a scheme to evade payment of his outstanding tax liabilities, largely by maintaining a cash lifestyle, avoiding the use of a personal bank account, and using the bank accounts of nominees, including his business managers, to pay personal expenses. For example, DMX received hundreds of thousands of dollars of royalty income from his music recordings. DMX caused that income to be deposited into the bank accounts of his managers, who then disbursed it to him in cash or used it to pay his personal expenses. DMX also participated in the “Celebrity Couples Therapy” television show in 2011 and 2012 and was paid $125,000 for his participation. When taxes were withheld from the check for the first installment of that fee by the producer, DMX refused to tape the remainder of the television show until the check was reissued without withholding taxes.

DMX took other steps to conceal his income from the IRS and others, including by filing a false affidavit in U.S. Bankruptcy Court that listed his income as “unknown” for 2011 and 2012, and as $10,000 for 2013. In fact, DMX received hundreds of thousands of dollars of income in each of those years.

In addition to his prison sentence, DMX was sentenced to three years of supervised release and ordered to pay $ 2,292,200 in restitution to the IRS.

Leave a Reply