Hermès’ revenues are on the rise again. The Paris-based luxury brand revealed this week that for the first half of the year, revenues were up 15 percent from the same 6-month period last year to $3.63 billion, while net profit (i.e., dollars earned after subtracting operating expenses, interest, taxes and preferred stock dividends) rose to $832.6 million compared to $781.7 million for the same period in 2018. The bag-maker stated that sales grew in every geographic region, including “positive momentum in continental China,” while competitors like Gucci, are said to be “losing brand heat” in the region.

The 182-year company’s positive results – including “a remarkable performance of the Ready-to-Wear and Accessories division” – come after its late-July report of “better-than-expected sales growth” for the second quarter, and preliminary projections that “sales in continental China, where Hermès recently revamped its e-commerce site, were particularly strong in the first half of 2019,” per Reuters. As a whole, Asia once again took the title of Hermès’ largest market, with a total of 52 percent of the brand’s sales, compared to 17 percent for the Americas and 17 percent for Europe excluding France, which is responsible for 12 percent of sales.

With such results in mind, Hermès stated this week that “despite growing economic, geopolitical and monetary uncertainties around the world,” whether it be enduring protests in Hong Kong, the effects of the ever-escalating U.S.-China trade war, or concerns over a messy Brexit, it “confirms an ambitious goal for revenue growth at constant exchange rates.”

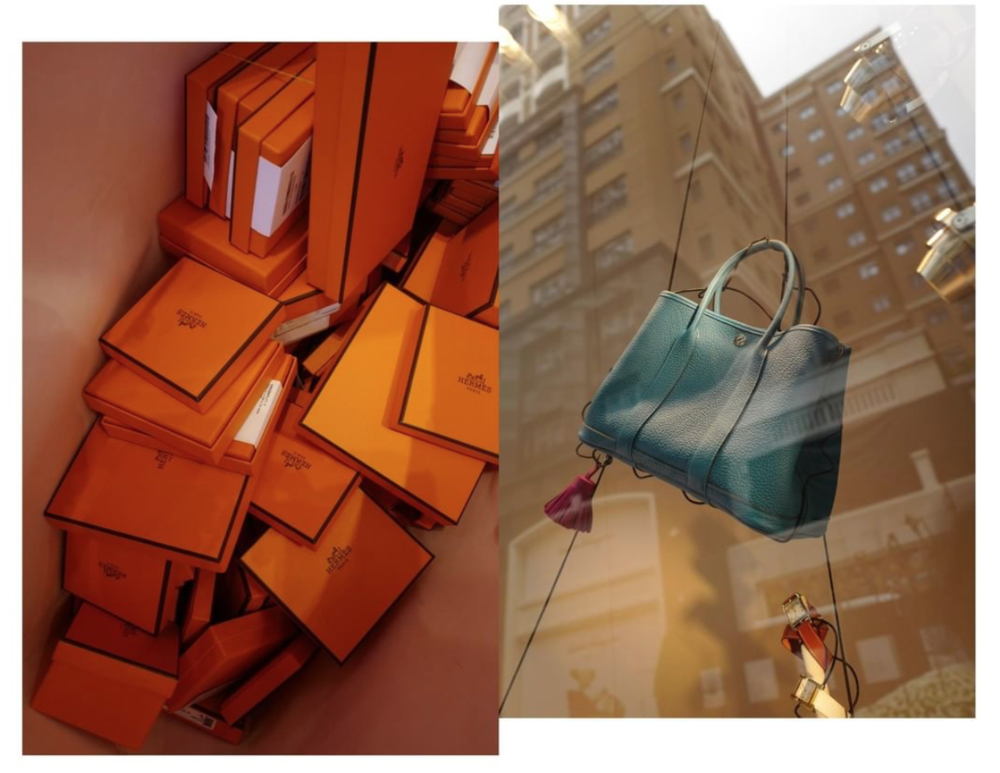

Such an optimistic outlook is unsurprising given that Hermès has long been known for its ability to weather social strife and economic downtown. The brand has routinely proven an attractive outlet for consumers, both in terms of its pricey offerings and its Paris Stock Exchange-listed stock. Not only are its leather goods, including its $10,000-plus Birkin and Kelly bags and coveted 24/24 and Constance offerings, subject to consistent consumer demand, “Investors are willing to stump up for Hermès, despite slower [stock] growth, because the company is considered a safe place to park money in a cyclical industry,” according to the Wall Street Journal’s Carol Ryan.

“Its shares bounced back quickly from the 2008 financial crisis and a Chinese slowdown five years later. The brand’s annual sales growth has dipped below 8 percent just once since 2010,” Ryan asserted. All the while, its “competitors have had a spikier time of it.”

The brand further asserted that “thanks to its unique business model, [it] is pursuing its long-term development strategy based on creativity, maintaining control over know-how and singular communication.” That successful strategy is, of course, largely dependent on Hermès’ ability to court – and maintain – demand for a handful of models of its bags, which is created by strictly limited supply.

And if all else fails, the brand revealed this spring that it will add an additional division to help drive revenue: skincare and cosmetics. As of 2020, it will begin to roll out cosmetics to implement its existing fragrance offerings, which will be a key category to attracting new consumers due to the drastic price difference from Hermès’ core offerings.

from The Fashion Law

Leave a Reply