- The study by WMG, University of Warwick and Blue Yonder examines how retailers have responded to the COVID-19 pandemic to ensure their survival

- The report highlights many points, particularly the need for human intervention as existing processes couldn’t keep up with changes in the markets

- Going forward future systems will need to be more robust and responsive, to increase speed and agility in the supply chain

The COVID-19 pandemic has changed the retail sector, a new study by WMG, University of Warwick, and Blue Yonder has examined how retailers have responded to the situation. The study identified the human vulnerabilities across the supply chain and the need for future investment in flexibility, visibility and automation to improve future resilience.

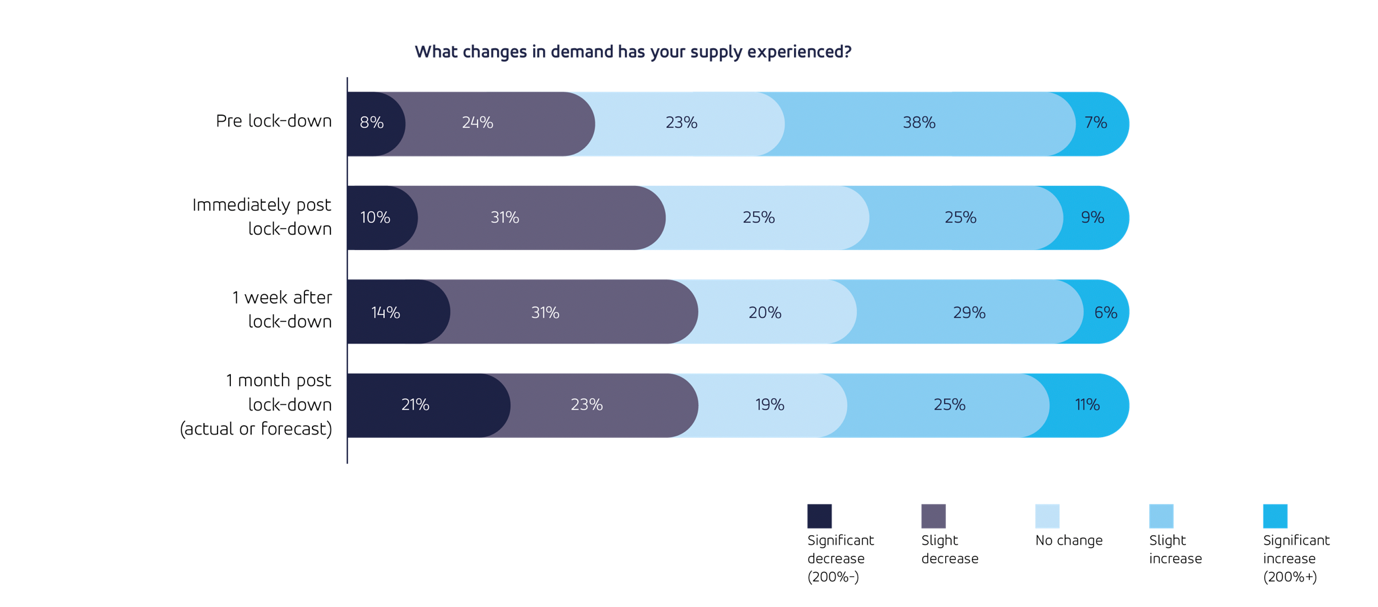

Retailers have faced multiple challenges during the COVID-19 pandemic. Retailers have experienced a combination of unprecedented demand for some particular products whilst no demand for others. Many stores have been forced to close, or adapt their operations to accommodate social distancing. Where possible, there has been a shift to online shopping, but this is not always possible and presents its own operational challenges.

The study gathered insights from 105 different retailers from Europe, Asia and the Americas who offered a glimpse into their survival and navigation of the COVID-19 crisis.

The study found that:

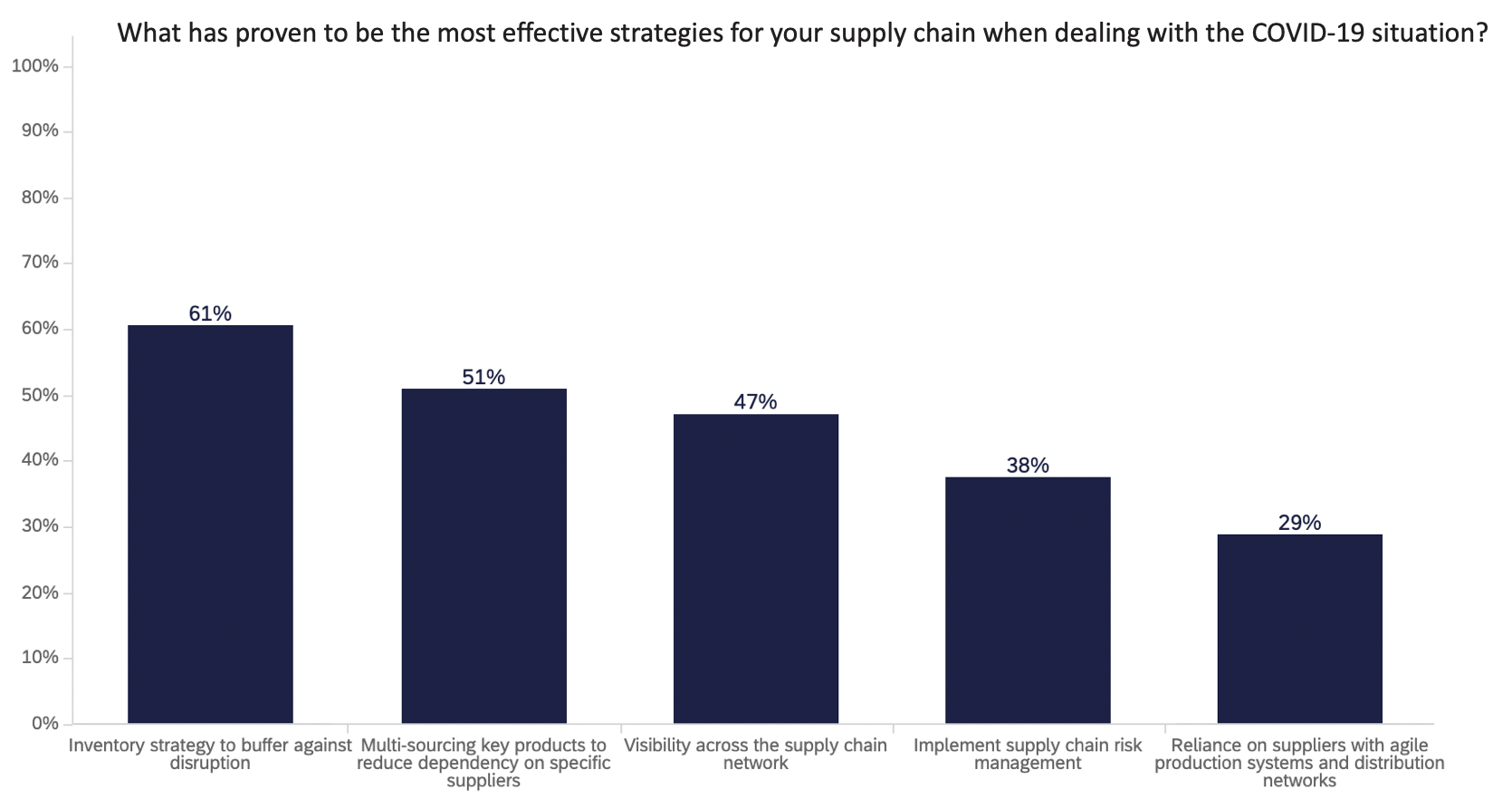

- The majority (61%) of retailers used inventory to buffer against the disruption of COVID-19. Supply chain processes and systems were effective, but more than half (58%) of retailers said a high degree of manual intervention was required to respond to the fluctuation in demand and supply.

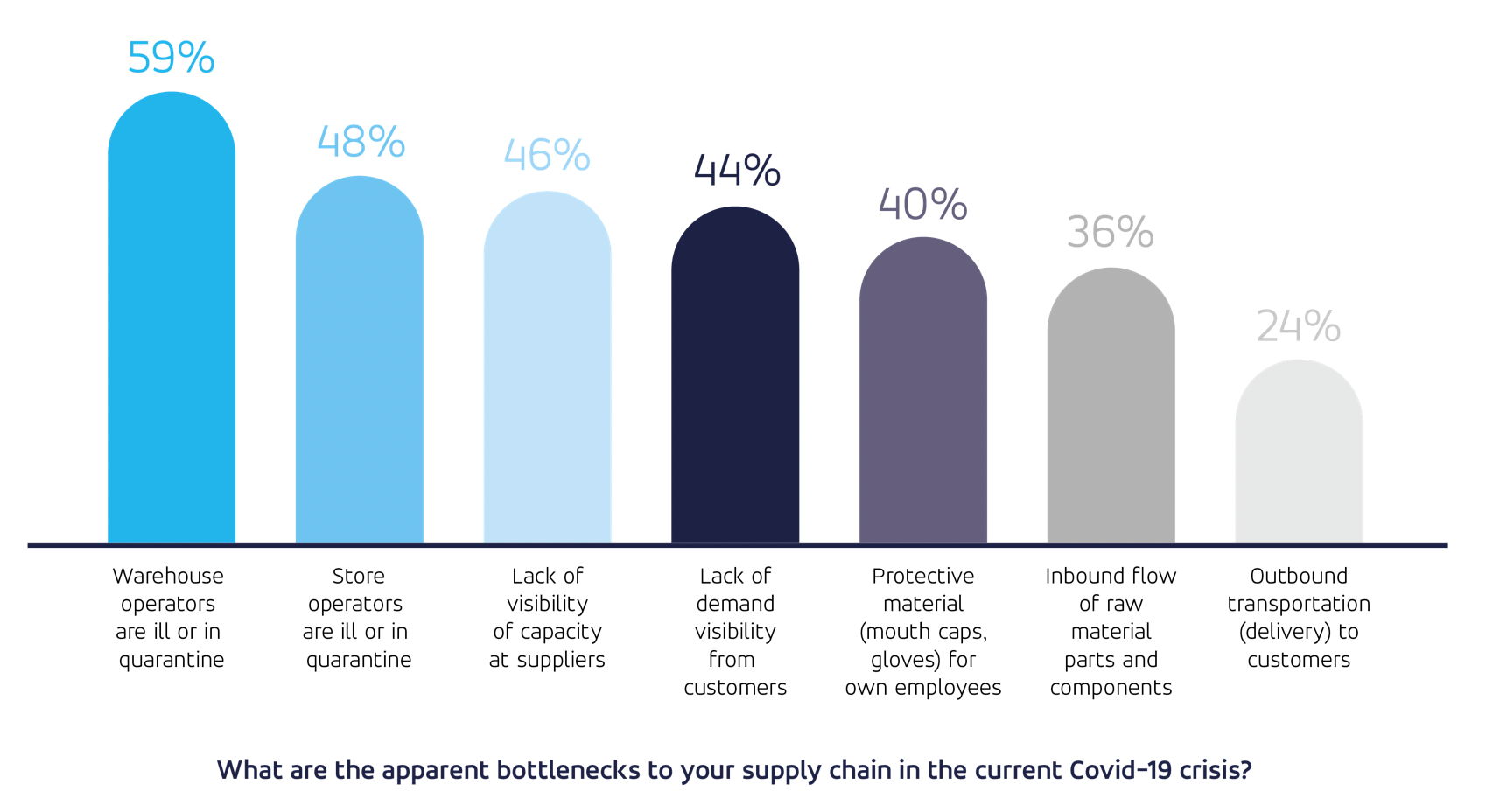

- Workforce issues were dominant issues for retailers with 59% of warehouse and 48% store operatives being affected by quarantine or illness. This often resulted in the closure of online operations and the need to recruit temporary staff.

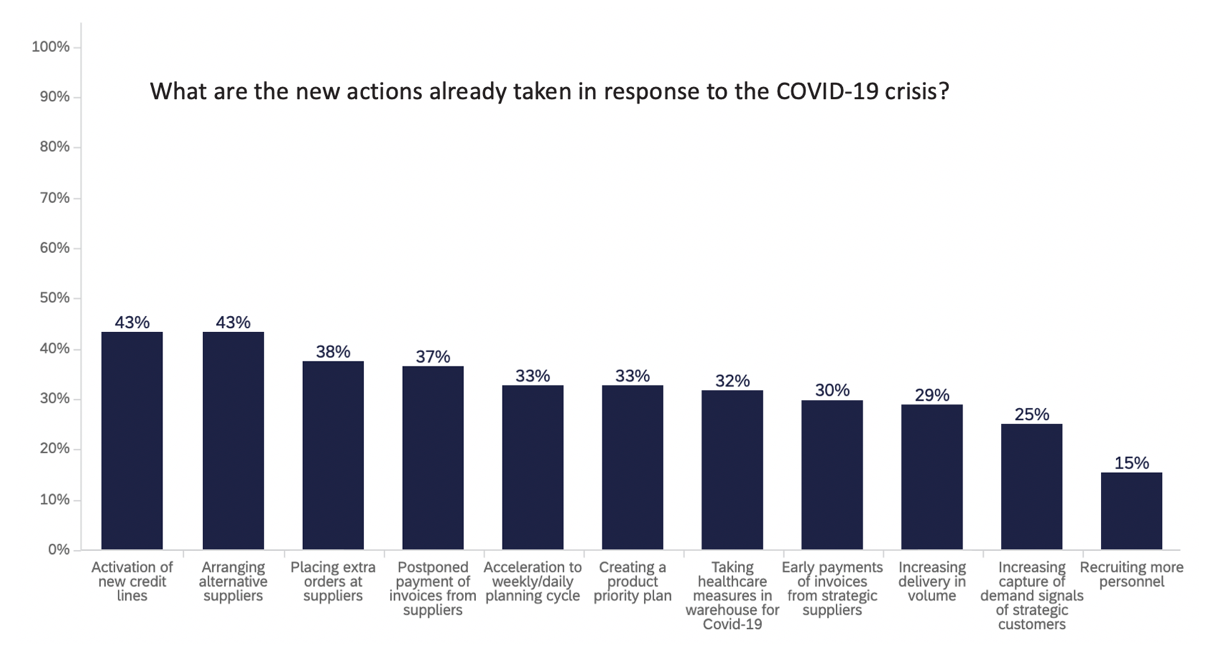

- Retailers were polarised in their treatment of supplier payments, with 37% delaying payments and 30% making early payments.

Jan Godsell, Professor of Operations and Supply Chain Strategy at WMG, University of Warwick, comments:

“using inventory to buffer against the disruption of COVID-19 was the most common strategy deployed by retailers. This provides the greatest certainty of supply but comes at a cost. In contrast, only just over a quarter (29%) of retailers relied on suppliers with more agile manufacturing and distribution networks, which is a potentially more resource efficient and resilient response.

With 75 to 80% of products seeing a demand fluctuation, retailers were slightly better at responding to decreases rather than increases in demand. Whilst retailers found that their supply chain processes and systems to be effective in responding to the demand fluctuations, many were still dependent on the human touch.

From warehouse and store operatives being affected by quarantine or illness to an over-dependence on human intervention within supply chain planning, COVID-19 has highlighted the human vulnerabilities across retail supply chains.”

Wayne Snyder, Vice President Retail Strategy, EMEA at Blue Yonder, comments:

“Early indications in Asia show that customers have been most supportive of those retailers they deemed to have responded best to the crisis and we’d expect that pattern to follow across Europe and the US. A critical learning for retailers is the need to invest in creating supply chains with greater flexibility, visibility and automation. Here technologies such as artificial intelligence and machine learning will play a key role in helping retailers navigate future disruption, whilst still meeting customers’ expectations.”

The survey was administered on-line by Qualtrics in late April 2020. It was targeted at senior executives in retail supply chains, in Europe, Asia and the Americas. 105 responses were received with relatively equal distribution across the regions.

Leave a Reply